Gold price is up:

It’s the highest it’s been since the panic-spike in 2011-2013, both in EUR and USD. However, if we remove that spike from the graph and see what it looks like then, we can see something else. I’ll show you another graph, this time in USD, to make it clearer:

Let’s get some painfully obvious things out of the way. First, this is not the price of gold. It’s the value of paper currency over time, measured in gold. Some people have calculated that gold and silver can be used as a very steady marker of value from Roman times up until today, measured in things like a good suit, lunch or a goat. So, essentially, if a good suit cost you the same amount of gold in ancient Rome as it does now, it’s not gold that’s getting more expensive over time, as the graph seems to indicate. The graph shows inflation.

Another obvious thing on the graph is that paper currency doesn’t just fluctuate randomly. There are patterns: times where it keeps steady value, and inflatory spikes. Unfortunately, the graph doesn’t show the Nixon shock in 1971, where “the dollar plunged by a third during the 1970s”, or the “Executive Order 6102” from 1933, which “made gold clauses unenforceable, and changed the value of gold from $20.67 to $35 per ounce, thereby devaluing the U.S. dollar”, to quote Wikipedia.

The third obvious thing is that we are on top of a very nasty-looking inflation trend, and although one would naturally attribute that to the financial crisis of 2007-08, it appears to have started some years before that, and it’s possible that the crisis was a consequence of inflation, not the other way around. You see, the crisis was triggered by sub-prime mortgage loans market collapse, but what if the root cause was in the reduced purchasing ability of the homeowners due to inflation, triggering defaults? This is an interesting thesis that would require some deep data mining to prove or disprove.

Now we are getting into the realm of the non-obvious. Something seems to have happened around 2002 that gradually reduced the purchasing power of the populace in real terms. There are many candidates: globalization and outsourcing, printing money to finance wars, but the date itself is indicative of 9/11. Whether the event itself triggered other events that were harmful, or it was used as an excuse to implement harmful things that were being prepared in advance, that I can’t tell, because it’s probably a combination of both. However, the graph indicates that the purchasing power of EUR and USD measured in gold are continually falling on a steep curve, and my hunch says we are approaching a hyperinflatory phase of a complete economic collapse.

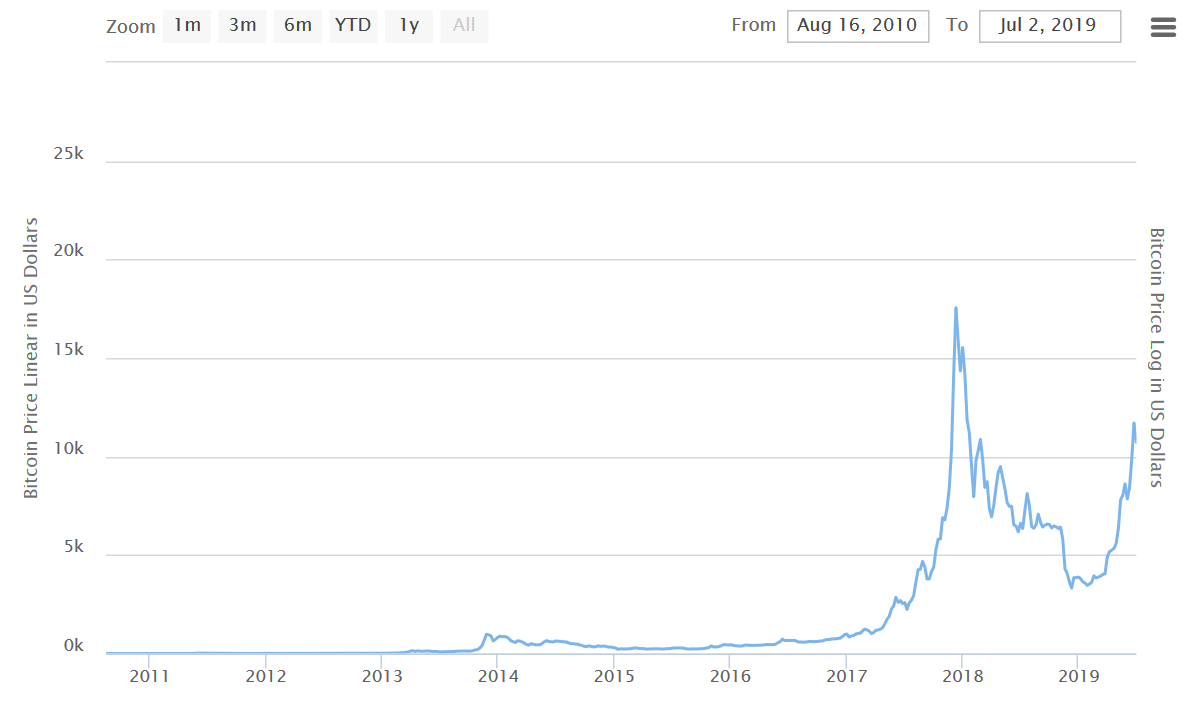

Let me show you another graph, of Bitcoin price over time:

My interpretation is that the post-9/11 restrictions on the financial markets and all kinds of Fascist policies with newspeak names had the result of people hysterically trying to rescue their money and the so-called crypto-currencies appeared as an alternative to the banking system, SWIFT and the credit card mafia. Bitcoin price is not a great indicator because it behaves like a high-risk investment paper, and not like a financial safe-haven, but apparently if you want a safe haven against America and the banking system, crypto is not at all bad, if you can get out of it in time, because crypto is a financial version of the Schroedinger’s cat: you can think it has value based on some graph, but you only get to learn what it’s worth when you want to sell it, basically at the point of collapse of the greed-curve.

My general recommendation is that the greatest losses in any financial crisis will be suffered to the investment papers with the highest level of abstraction. Essentially, the farther away from the real thing, the greatest the danger, because bullshit, hype, greed and deception always hide in the high levels of abstraction, which can also be read as “bullshit”. The historic lesson with complex financial packages based on bad mortgage loans should be obvious. In times directly preceding a crisis, bullshit-papers create bubbles and trick investors into buying, but when the panic starts, the value of something is always determined by how much someone is willing to pay you for it, not by what you paid for it, and when a bubble bursts, there are no longer any buyers. At that point, everybody hysterically tries to save money by putting it into safe havens, but by then it’s too late.

Essentially, buy precious metals when everybody buys high-risk, high-reward papers, and when everybody goes crazy because the bubble burst, do nothing. Wait it out, then convert metals into a rational wealth-generation plan. This is essential, because as good gold is as a store of value, it doesn’t actually produce additional value by just sitting there, and you need this generation of profit in order to be able to pay for your expenses. This is what my advice would be if this was just another big bad crisis. However, other indicators show that it’s not just about the monetary system, or the economy. The western civilization itself seems to be in its death throes, and we haven’t seen anything that bad since the fall of the Western Roman Empire.

Well, I lived in a time where we grew all our food, without any heavy machinery.

I am sure we can do it again, we even have most of the old seeds and I am sure we can get the rest.

Sure, we can’t protect ourselves against firearms – but what do I even care? They are free to shoot me if they can grow their own food.

And no, I won’t work as a slave, if I will share resources with them, it will be on my terms, not theirs – because once again – they are free to shoot me and die of hunger.

I couldn’t assume that people reading this own agricultural land, but if they do, stocking up on seeds and fertilizer is a cheap and effective survival strategy for a medium-sized disaster. If I had agricultural land I would certainly take that kind of precautions.

You are right, most people reading this probably don’t have that option, but it seemed worth mentioning anyway in case someone might actually want to create that option.

Farming is not nuclear science, it’s just hard 🙂

Well from my recent and very limited experience with agriculture, It’s hard if you try to grow everything organic. If you use artificial fertilizers and spray crops with insecticide it’s relatively easy.

My wife bought tons of seeds online from eco friendly sources, and we started growing some veggies since last year, but it’s hard work to grow organic.

Yea, why do you think I ran to IT? 🙂

As a kid I spent a good deal of each summer in the fields being the fertilizer and insecticide 🙂

And for as long as there is IT, I will stay away from fields.

But if there is nothing else to to do and there is no food, I know I can always go back.

Which will give my deceased gran grandma a good laugh 🙂

You can imagine her opinion on IT 30 years ago 🙂

I can imagine 🙂 well we started this more as a form of fun and relaxation, and to get away from stressful city life, so it’s kinda different thing 🙂

https://www.youtube.com/watch?v=CFGZPxgQt9w

As for Bitcoin and other crypto, this is a very high-level abstraction artifact and has any meaning only in a high-level abstraction civilization. It’s the first thing to become worthless in a real crisis, and if I had any, I would sell it all now when the prices are high, and convert the proceedings into gold bullion. Have in mind that one single declaration about Bitcoin’s inherent illegality from America can render it immediately worthless. Just have this in mind: https://www.whitehouse.gov/briefings-statements/presidential-message-congress-united-states-2/

Just one such declaration and you can wipe your arse with bitcoin because it will be rendered inconvertible into any real asset.

Depends, I heard even some wild rumours that it could be even American construct which could have some validity as Chinese banned legal crypto exchanges two years ago as they were not sure about it. Although, nothing stopped them from producing mining equipment and making money on it.

As for value of Bitcoin right now, it seem like blown totally out of proportion. Current price is function of some factors like volume of trade, and the most of it is faked, so we have washtrading here. Of course, you have to have ways of buying it and there is USD Tether, crypto which is pegged to USD value. Bitfinex is pulling it out of a thin air i.e doesn’t have coverage in real USD for it but hey, it’s not like USD has coverage in something other that US power on convincing other that they need it to trade oil … or else. 😀

As the final word … if US doesn’t outright ban it and we get to another major financial crises in 2020 Bitcoin could hit the Moon and beyond, maybe?!

I don’t think so. Bitcoin is something like the Croatian real estate market. Everybody is raising prices and nobody is selling anything. Literally; the agents are super frustrated because the owners keep calling them daily to raise prices for some reason, and nobody is actually making any offers. It’s a very similar greed cycle, where poor and desperate people imagine that something they own is so valuable it will solve all their problems forever, and this fantasy isn’t easily dispelled. Bitcoin is like me trying to sell a unique piece of paper from my table for a million dollars. Technically, if I put out an ad, it’s priced a million dollars. However, in reality it’s worth the amount I can actually get for it. That’s why I say it’s a Schroedinger’s cat. It exists somewhere between the advertised price that is huge, and the price you would actually get if you tried to sell it.

Greed was actually boosted by stupid Croatia government that decided to subsidize mortgages thus increasing prices i.e. real estate owners or developers just increased the price for the amount subsidized and … there goes the neighborhood. Till the next episode of financial crises at least.

Bitcoin could flop one more time this year if some US government’s comission decides that USD Tether doesn’t have backing in real USD. Maybe it would be final nail in Bitcoin’s coffin or it could be an opportunity to go all in before next greed cycle?!

Bitcoin has its uses, such as evading artificial payment restrictions, but it’s definitely not a safe haven where you put money ahead of the storm. Even investment gold is sensitive to the state that simply issues a decree banning its use and demanding that all gold bullion be turned in and replaced with worthless paper, but you can at least ignore that and go underground. With crypto, it simply can’t end well for the people who stay in it too long. Those who play it well can end up with lots of gold, and those who don’t can end up with worthless numbers on a thumb drive.

Also, and I didn’t test this, the VAT on silver bullion is 19%, so it makes sense to order online from Germany. I haven’t tried it so I don’t know if our local thieves will allow it.

If VAT rate is to be considered then buying from Switzerland which has 8% VAT seem like best option.

Switzerland is not in EU, or at least it wasn’t the last time I looked. 🙂 That means you’d have to pay their VAT, pay HR VAT, and then file for Swiss VAT return.

Estonia, however, is in the EU and doesn’t charge VAT on silver, but other countries don’t like it much. You’d have to physically go there and bring it here and then there’s still the question of HR VAT. So essentially it’s a mess.

Yes, I stand corrected now with regards to Switzerland. I forgot good old days of internet shopping when you had to report to infamous Jadranka Posavec at customs in post office in Branimirova for every shit purchased. 😬 Besides the Croatian VAT there was always customs to be paid but that was always peanuts in comparison.

As for Estonia, tax authorities are quite flexible on interpretation of tax laws and how they do apply to their citizens especially in a way that works in their favor. 😎 I’d say that as a private person you pay VAT in the country of purchase. At least it should work like that between EU countries.

Another thing: buying gold bullion is something that makes sense if you have considerable savings in a bank account and you want to protect it against EUR/USD inflation. My rule of the thumb would be that if you have less than 5K€ in savings, don’t bother with gold, because you’ll be better off buying 1K€ of 1oz silver Philharmonikers and as much non-perishable food as you can fit in your place, plus a few bottles of chlorine-based water disinfectant. I’m slightly exaggerating but you get the drift.

That would work only in case of disruptions in water/electricity supplies that last for not more than a week cause I guess everything longer than that would be serious FUBAR situation and I can’t stock-up for a life-time. 🙂

Well, there’s always a possibility that a medium-sized crisis is going to hit first, and that one might be survivable.

Also, I need to preempt the questions about silver. There are several problems with silver. First, some 50% of the market demand for silver is industrial. This means that the demand is going to go that much down in case of a crisis, and the prices are actually going to drop. Also, there’s VAT on bullion silver in EU, which in case of Croatia means 25%, making it a particularly poor investment compared to gold bullion.

Also, silver is much bulkier per unit of value than gold, so it’s a rather poor store of value if you need great amounts; if you want to feel rich because you have lots of bricks of silver, go right ahead. 🙂

The advantage of silver is that amounts usable for daily trade, such as groceries, fuel etc., are much more manageable, so it actually makes sense to buy a few hundred EUR worth of 1oz silver coins for daily food consumption in case of extreme hyperinflation. It’s cheap insurance against Argentina or Venezuela situation.

It seem that tax is also paid in some countries of EU is weigh of golden bar is less than 1 gram according to this link:

https://otkupsrebraizlata.com/zlatne-poluge-od-jednoga-grama/

Shouldn’t it be for us guys in Europe mainland standard to buy/sell gold/silver/… in grams not oz? I never liked those imperial units. 😀

Honestly, 1 gram is so little, it probably registers as jewelry and not investment gold. As for the troy oz, yeah, I agree and I always calculate metals in metric units, but the 1oz and fractional coins seem to be standard. 1oz is around 31g, which is realistically the kind of a minimum weight you would consider when buying investment gold. There are oz/fractional coins as well, but I see those as means of paying exact amounts or receiving change for a transaction. 1oz of gold is around 1300 EUR, which is a significant amount of money, and, as I said, it’s just around that kind of money where gold starts making more sense than silver. 1oz coins are what you use to buy a gun or a cow, 250g and heavier bars are what you use to buy a car or a house.

I have pretty much idea how buying/selling cryptocurrencies/stocks so I guess buying gold should work the same way?

I’m not sure if buying it physically is the smartest idea unless it would be the case that the whole global telecom infrastructure collapses due to EMP bursts coming from some major nuclear exchange between US, Russia and China?

Actually, buying physical gold is the only way to go, because the paper gold markets are incredibly over-leveraged, essentially they issued 3x more paper than they have gold in store, so, you tell me what’s going to happen when people start demanding physical delivery. The entire paper market is mostly air, and when that becomes obvious, shit is really going to hit the fan.

I heard over the years many suspicions about if Fort Knox actually possesses that amount of gold like being declared or some of it is actually, I don’t know, let’s say lead covered with thin layer of gold. So, it should be no surprise that issuers of IOU gold certificated would have a same business practice. :

As I said in a previous article, give someone the ability to issue papers with gold coins as backing, and you’ll inevitably have more papers than gold coins. It’s just human nature.

Actually, to correct myself, according to Sinclair it’s not 3x but 300x more paper gold than the actual gold that can be delivered. Of course, you have the option of buying an actual gold bar with a serial number that’s deposited in a safe somewhere, but that’s going to be confiscated the moment something really bad happens to the bank/state/economy/world.