The banks worldwide are preparing the legal framework for the bail-in, which means they will basically prevent their bankruptcy by adding a portion or totality of all customer funds to their balance sheet.

In plain language, the Cyprus solution set a precedent. There are several ways a bank can handle bankruptcy. It can be bought by a larger bank (bank depositors win, larger bank absorbs the cost), it can be fixed by the state using tax money (bank depositors win, tax payers lose), it can simply go bankrupt (bank depositors lose everything), or, as it happened in Cyprus, the bank can add a portion of all deposits to its own balance sheet and fix itself (bank depositors lose a third or more of their money, but the state is happy because it doesn’t have to spend tax money on fixing a broke bank, and the bank is happy because it doesn’t have to try and find a bigger bank crazy enough to pour money into a pit of doom).

In even plainer language, the banks are all in serious shit, massive bankruptcies of major players are on the horizon, and they intend to screw you over. If you have significant amounts of money in the bank, take it out and convert everything you don’t need for monthly expenses into gold bullion, because when this shitstorm strikes, anybody close will not be smelling like roses.

This also puts a different light on their recent attempts to discourage the use of cash. It’s certainly not because of “money laundering and financing terrorism”, it’s actually because if you have cash with you, they can’t steal it. If it’s on their account, they control your access to your money. If you have cash, they don’t control anything. Also, that’s the reason why the state wants you to have everything on your bank account: if it’s there, the banks can steal it and the state doesn’t have to use tax money to fix the banks, and they can also create huge amounts of digital money out of thin air without anyone actually knowing the amount of money in circulation. Makes inflation much easier and cheaper for them. So, essentially, if you own gold you must be a terrorist. 🙂

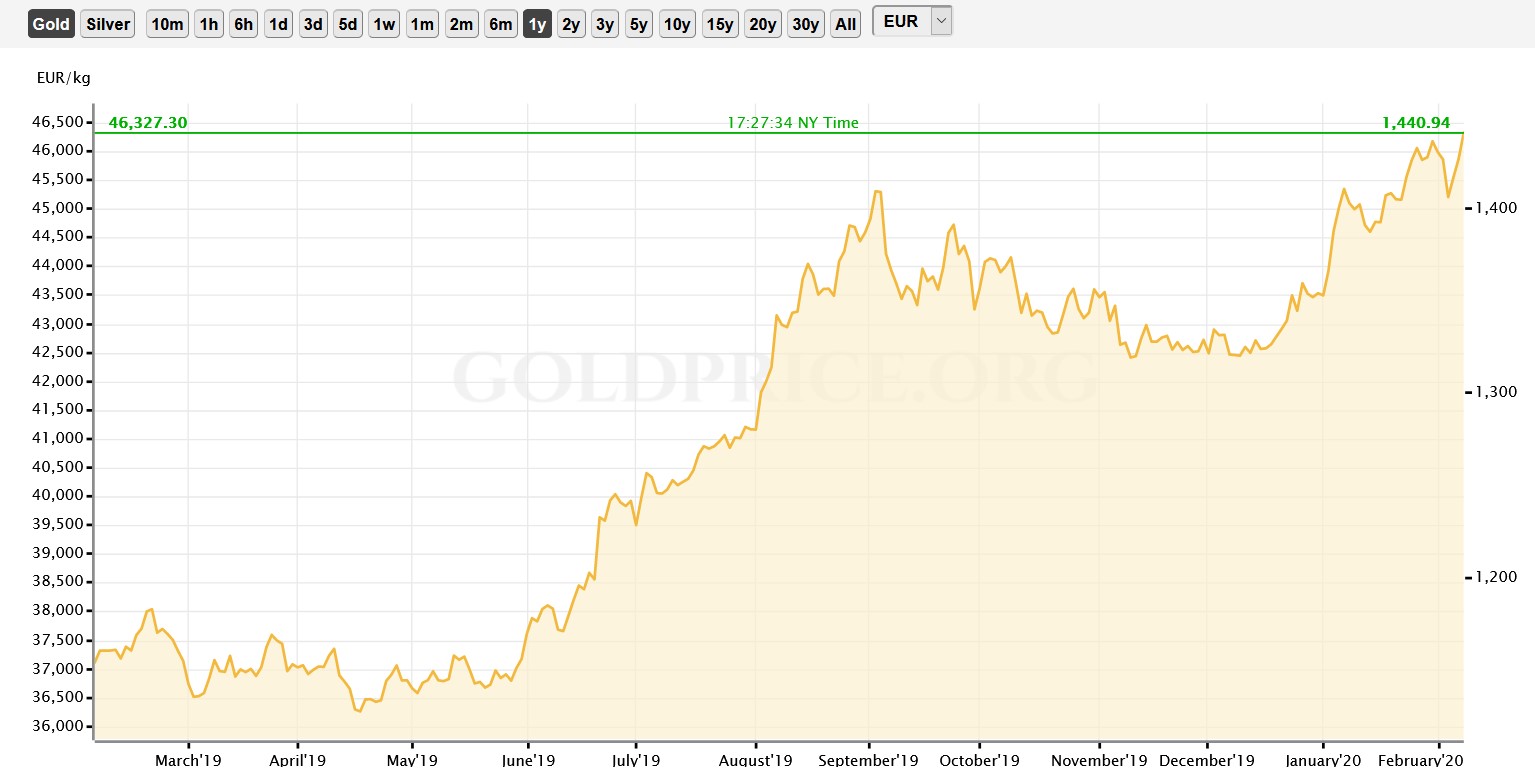

Oh yeah, I almost forgot. Allow me to remind you what gold did in the last 12 months:

Yes, that’s the all time high. In plain language, if you bought a Krugerrand in 2005, it cost you around 300 EUR. Today you would pay around 1500 EUR. Either gold appreciated 5 fold in 15 years, or Euro was diluted to shit in 15 years. You tell me. In any case, if you kept your money in the bank, you can now wipe your arse with it. If you kept it in form of Krugerrands, you can now buy five times more euros. To me it doesn’t matter much because I was dirt poor 15 years ago, had neither money nor gold so yeah.