I’m back from Hvar, and I must admit I’ve been naughty and occasionally went online to check the news, or, to be accurate, to check how the American civil war v.2.0 is going. Honestly, the amount of outright madness I’ve seen was enough for even me to grab my head in “what the actual fuck” moments.

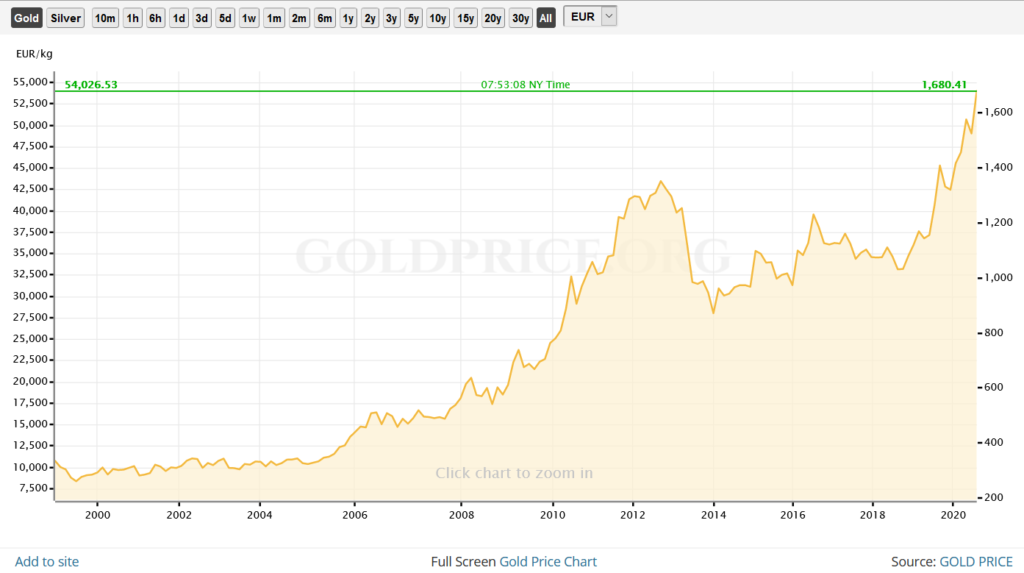

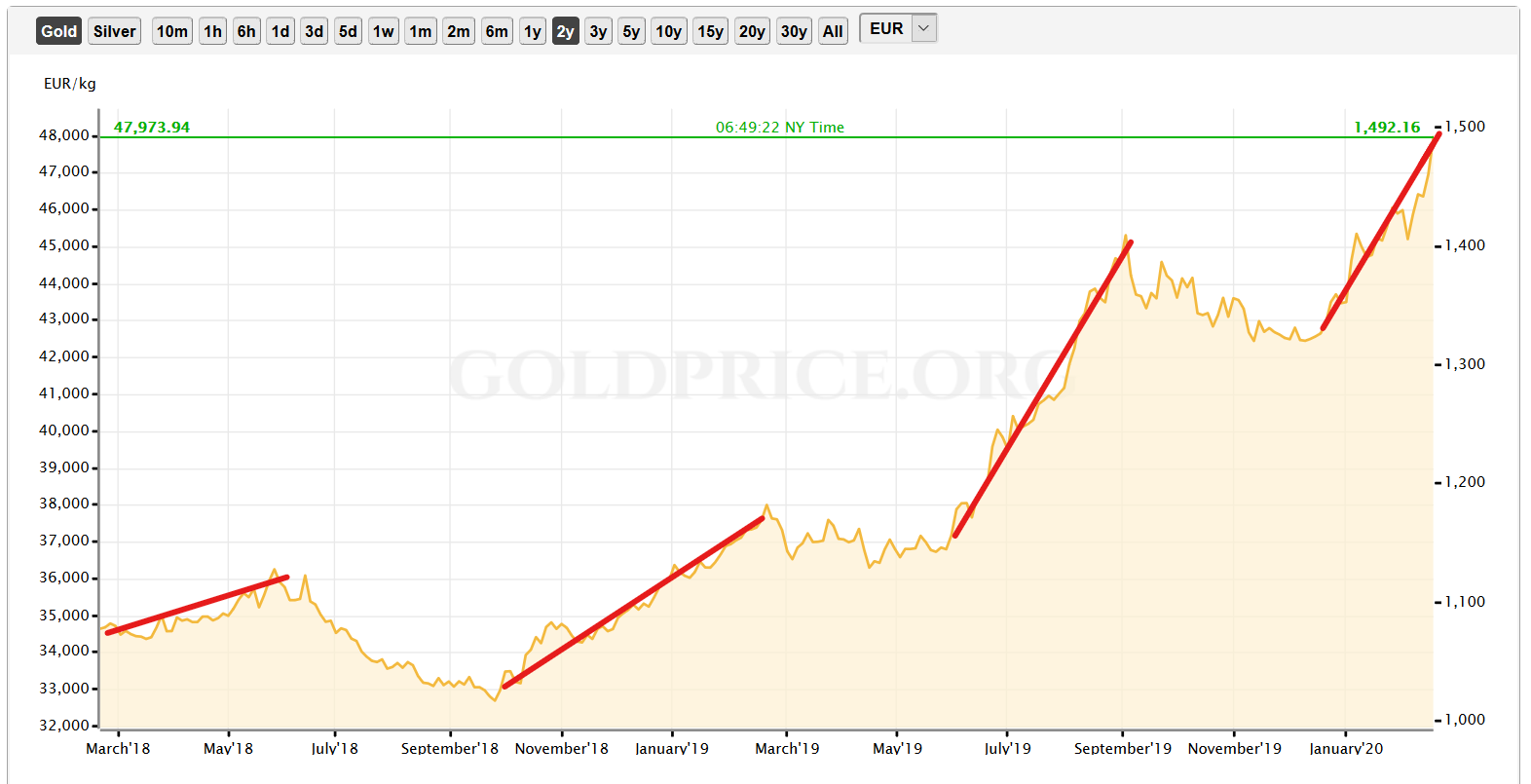

One of the biggest WTF moments was the realization that the stock prices are in inverse proportion to the state of the economy, basically the worse the economy is doing, the more the stock prices are surging. That’s because the federal reserve bank essentially promised to buy out the failing companies, so the greater likelihood of a bankruptcy, the greater the likelihood of a fed bailout, which is then expected to raise the stock price and people are buying in anticipation. However, that’s the point where America kissed the free market goodbye, essentially transforming their entire economy into something so entirely state-controlled and regulated, that China looks like free market heaven in comparison. Essentially, they broke the fundamental of the free market capitalist economy, which is that stock prices reflect profitability of the company itself. As of now, the stock prices reflect only the expectation of state intervention. However, if everything on the market is broke and requires state intervention, it reminds me of something I’ve already seen before, which is the state of the economy in Yugoslavia before the collapse, where the main points of political contention were the big companies that employed lots of people and couldn’t be allowed to fail, so state money was continually pumped into them to compensate for the losses, and since the state itself was not productive, meaning it couldn’t come up with enough actual money for this process of fixing broken industry instead of being propped up by the productive industry, it resorted to printing money, which caused a devastating hyperinflation that at least contributed to, if not outright caused the collapse of the Yugoslav state. People can point at nationalism as the cause of the breakdown all they want, but, as in the Soviet Union, the surge of nationalism was preceded by a serious economic crisis – currency collapse, shortages and the basic inability to make a living from honest work, because prices were adjusted daily, and salaries were adjusted monthly. After a few years of survival in such a devastated economy, people tend to just throw in the towel and say “fuck it, I’m done with this”, and they want things to change. Basically, the nationalists say that the big federal state is to blame for all this, which is of course true, and promise to make it all better by tearing it all down and reclaiming the statehood on the smaller, national units, which of course is a fallacy but at that point of economic exhaustion the people just aren’t interested in that kind of nuance. They want things to change, and immediately, because their condition is unbearable. Essentially, when you have a situation where the economic condition of the majority of the population is unbearably bad, any sufficiently organized political force that offers some way out might cause complete breakdown and disintegration of a large federally organized state, especially if one part of the federation has reason to believe that the other part is taking advantage of them and causing their problems, so political solutions are no longer possible. In Yugoslavia, Slovenia and Croatia had good reasons to believe that they were being systematically economically degraded by Serbia, which controlled the central government and used their productive economies to prop up unproductive parts of the country, basically bleeding them for money that should have been used to improve their own infrastructure and living conditions. In America, there is a very narrow segment of the population that lives in New York and California, that controls the entirety of the flow of money, and is perceived to bleed the rest of the country dry, creating the impression where work of an investment banker is worth millions of dollars a month, while work of a normal middle-class person is worth a few thousands a month, and the situation is getting even more extreme as a function of time. You can’t convince me that the work those stock market people are doing is actually that much more valuable than work of some engineer that designs sophisticated machinery or electronics; rather, they are the ones in the control room of the financial system and they are exploiting its weaknesses to make most of the money that’s in circulation circulate in dead loops where they bleed this mass for percentage points, and this money never gets to be invested in the actual economy, because that’s seen as “risky” and slow. This makes the entire economy ungrounded, like a tree that’s all branches and no roots, because roots are seen as “unproductive” and the branches are the sole measure of success. Essentially, if your company stock price is seen as the sole measure of value, and your engineers and workers are seen as a liability because they just cost money, you get started on a vicious cycle where you fire your most expensive workers, basically the engineers that design the product, and you hire marketing people to boost sales, and you get loans that are invested not in the actual development and manufacturing, but in buying your own stocks, which will raise the stock price as the sole measure of value. Then you get a company that is an empty shell containing only debt and salespeople, and the problem with this is that every single company on the market has to adopt the same measures in order to keep up with the competition that would otherwise obtain better financial indicators, thus getting preferential access to credit and, thus, a lever that would give them a huge competitive advantage. This also means that the risk-assessment in the banking sector is tuned to prefer the bigger companies, to the point where all the money is sucked into a dark tornado cloud of the biggest companies, while the small and medium sized businesses are seen as “high risk”, because they actually are dealing with the free market and they have free market issues, which the banking system sees as the messy cesspool of risk and non-compliance, so when the government wants to make an infusion of money into businesses, you need to understand what happens. The state does it through the banking system: the central bank prints money and offers a cheap loan to the commercial banks that then resell it to the businesses. Since the bank can’t just set aside its normal risk management and compliance procedures just because the politicians want to help small businesses, what actually happens is that the bank’s risk department does a SQL query on the table of companies asking for loans, sorting them by risk overhead, ascending, and spending all the money on the top 5 or 10 claimants, of 100000. Those 5 are always the bank’s existing clients, and the ones that are the biggest, and with the biggest extant loans. So, that’s why the government can’t even theoretically help the small businesses – the entire mechanism is already rigged to suck all the money into the biggest companies, and it can’t be modified just because someone said so. It’s actually illegal for the banks to go against the recommendations of their risk departments, so, whatever the politicians say about propping up small and medium businesses, for the most part they are either deceiving you or they don’t know what they are talking about, because it technically can’t be done. What can be done is to reduce the taxes, because that’s not done through the banks, but through the revenue service. However, as a rule, the taxes don’t really go down, so such measures are short lived.

So, when the communists tell you that this quagmire is evidence that capitalism is a corrupt system, I don’t really know what they are talking about, because true free market capitalism is practiced only by the group that is almost completely excluded from this entire corrupt charade: by the small and medium business owners and freelancers. They are engaged in a no holds barred cage fight with the competition, where they have to struggle through increasingly limiting and pointless “state regulations”, and they can’t get loans from the banks because what they do is “high risk”. The part of the market where all the money is, meaning the feedback loop between the federal reserve bank, the commercial bank, big business and the politicians, is a state-regulated, state-controlled fraud scheme in which companies race to go bankrupt first because then they get to be bailed out by the state, which cleans up their liabilities and toxic assets and makes them all shiny and new, and the bill for this entire thing is of course served to the general public and the next generations, because all those government bonds issued to fund all the money printing are going to mature eventually, although it’s obvious that nobody really takes the option of actually servicing all that debt seriously. Right now, they are printing money like crazy while it’s still perceived to be worth something, they are using it to suck up all the resources from the economy, and when it all collapses they’ll just reset the system. Basically, the entire thing can be seen as a financial equivalent of a thermodynamic system which pumps energy from the coldest part of the system (the poorest part of the population) into the hottest part of the system (the wealthiest part of the population). The game ends when it reaches the point where all the resources have been sucked away from the 99% of the population and the top 1% has all the worthless monopoly money, and of course all the actual resources which they obtained with the said money before it became worthless.

Perhaps the most toxic part of the entire problem is that the system collapses with some regularity, and with each cycle the politicians claim that it collapsed because there wasn’t enough state regulation, so they introduce additional layers of regulation, which is of course muddy water in which the biggest players navigate most easily because they can afford whole legal departments to deal with it, while the small businesses are increasingly crippled by the need to deal with all this unproductive administrative junk, and this also means that the banks are less likely to give them loans, because of the stringent risk and compliance procedures. This means that with each cycle of regulation, the system is increasingly more rigged to favour the biggest players and to extinguish the free market capitalist part of the economy. In turn, this means that every cycle makes it more profitable to play with money and regulations than to do anything actually productive, which basically means that the regulations that are intended to make the system less corrupt in fact make it more corrupt. You can’t explain that to the common people, who think that state regulations exist to save them from the evil capitalists who “want to break the law and thus cause the market crashes”. In fact, the feedback loop between the state, the banks and the biggest companies is the problem, and the laws and regulations are a toy for the stupid masses. Basically, what the stupid masses believe is that a private doctor needs to be “regulated” in order for them to be safer. In fact, when a private doctor is “regulated”, it means he has to spend most of his time filling forms to comply with regulations, which makes him spend less time with patients and charge them more money for it to be able to pay for the government-imposed overhead, which makes the quality of his service less valuable and more expensive, essentially making people the opposite of safe. A doctor that fills forms instead of dealing with sick patients does not improve patient health and safety. Replace “doctor” with any occupation and you’ll get the same result; the regulations degrade the quality of service across the board, making things cost more and be worth less, but they are almost impossible to remove once they are in place because people are stupid and they have been made to believe that all those evil capitalists are out there to get them, and the thick book of regulations and the government imposing them are the only thing that saves them from doom. Also, there is a huge difference between what certain laws and regulations are in their essence, and how they are marketed to and perceived by the general public. Anti-money-laundering laws, for instance, are perceived as something that is meant to prevent the mafia from using money that originated from various forms of crime, in order to finance “clean” investments. That’s how it was marketed to the general public. What it’s actually about is the state wanting to assure that it can raise taxes as much as it wants, and you can’t move the money to an offshore company where the taxes are normal, in order to avoid being robbed by a state that ran out of money due to its fiscally imprudent practices and demagoguery (basically buying voters with tax money), and decided to introduce a demagoguery law stating that the evil kulaks took and hid all the money which is why people are poor, and the good state now needs to find and bleed all the kulaks and then everything will be great. That’s what it’s actually about, and the term “money laundering” is there just to convince the stupid general public that it’s about “dirty money”. No, dirty money is the only thing that is explicitly not the target of such laws and regulations, because such money is easily dealt with by other laws – for instance, if the money was actually a result of criminal enterprise, this criminal enterprise would be broken up by the police, crime would be proven in the court of law, and the money resulting from crime would be confiscated. No, what all those laws against “money laundering” and “financing terrorism” are about, is preventing Julian Assange to get funding for his project of revealing government crimes, and for preventing “kulaks” from “hiding wheat in the attic”. It’s a Stalinist overreach in state power, designed to do all the dirty work extrajudicially, basically delegating all the spying and evil to the banks and financial institutions, so that the cases never even go to court, because then it would be obvious that the entire thing is completely baseless and a violation of someone’s rights. This way, the state and the banks conspire to rob you of your rights in such a way that you never get your day in court against them and they can basically do whatever they want, while the people in general see the name of those laws and think it’s all for the good, because money laundering and financing terrorism are baaad (in sheep voice). When the problem becomes so bad that even the general population start taking notice, it’s already too late in the game of totalitarianism for anyone to be able to do anything about it. It’s like the Nazi Germany – why do you object to citizens being routinely stopped at checkpoints and asked for papers? Only criminals would have a problem with that. The problem is, the state’s idea about what is “criminal” might differ wildly from yours. You think a criminal is a murderer, a thief or a rapist. They think a criminal is a journalist who found out and released truthful information about government crimes to the general public. Just watch the Assange case. They invented false charges against him to deceive the general public, and when those were dropped, they invented other false charges, and what is the truth? The truth is that the American state and its entire government system is profoundly corrupt and inherently criminal, and he revealed the facts that showed this quite plainly to the general public, thus spoiling the corrupt government’s public image and making its job of controlling the population harder.

The situation with the recent police violence is similar – usually, the police can hide its criminality behind a fig leaf of some actual crime they were fighting, but when they murdered a few people in broad daylight, for minor infractions, and were recorded doing it, for all to see, it became very difficult for the general public to maintain the illusion of police only doing good work against hardened criminals and having to use violence because, well, they are being forced to. The facts of the matter are different: the police was trained to be extremely violent and arrogant, to use maximum force against minor provocations and for minor offences, and they are increasingly treating the people of America the way American military is treating foreigners in hostile countries – it’s police safety first, not serve and protect the citizens.

Of course, then we get to the point where a mob of black thugs and white communists starts robbing stores to “liberate” all those Nike shoes from the stores of white capitalist oppression, and people start wondering whether police might actually have a point, and it is truly difficult to see either side as good.

In any case, the calls to defund the police can easily be understood for what they are: government power needs to be scaled down because it went too far, but of course that never happens, because once the government gets power, it keeps it until the entire state structure is torn down, and sometimes even that only changes the flag and the name.

The apparently racial background of the issue is completely fake and is the result of deep racism of the American black community – I recently watched a video where a white guy describes his experiences with the police in the recent decades, and those experiences are as violently abusive as anything a black American could point at. However, he rightly notices that the problem is the militarization of the police force and a major change in its attitude, where police started actively looking for trouble and acting violently without any good reason, while a black person would immediately point to race as the cause. Why, because American blacks are the most racist people on Earth, who hide all their own failures behind the veil of imagined racism, while it is a fact that other blacks are the main problem a black person needs to overcome if he wants his life not to suck.